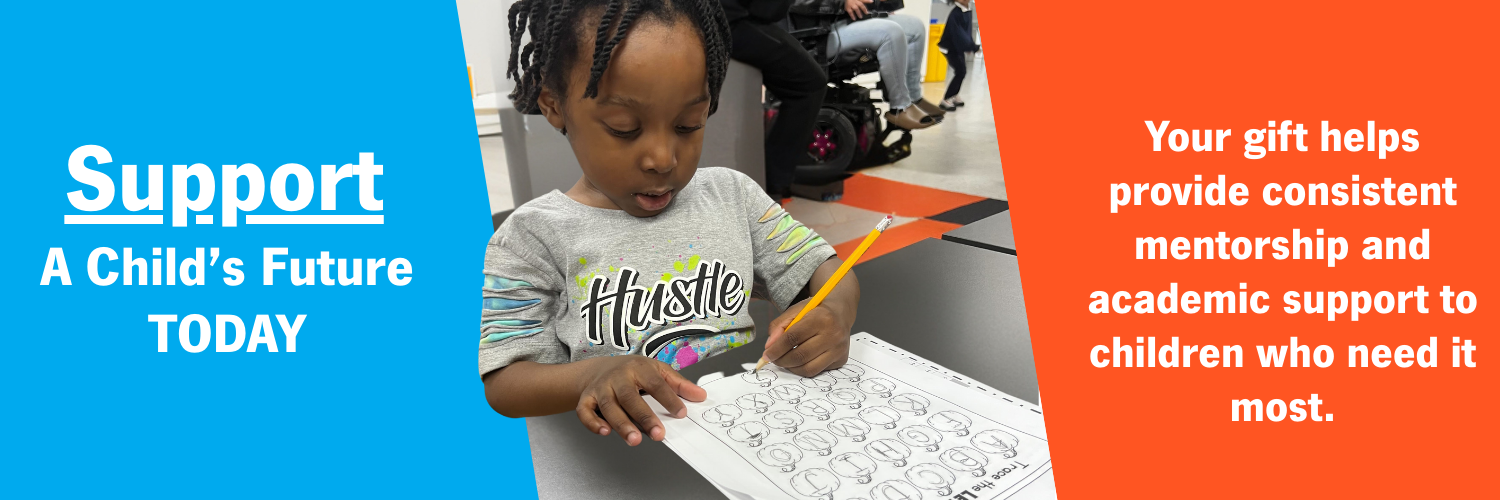

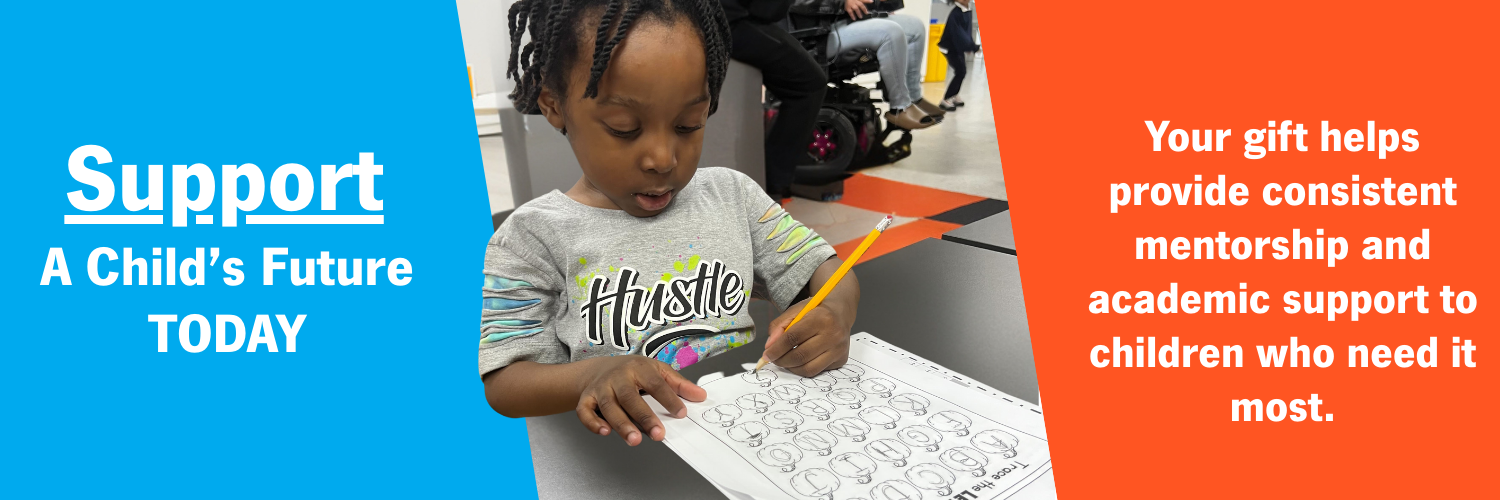

Help us stop the cycle of poverty and uncover a child’s real potential for long-term success in life. There are many different opportunities to support our organization by investing in our model, providing in-kind goods or services or becoming an individual or corporate sponsor. If you have questions about how you can best support our mission and work, contact us at srandon@friendsnewyork.org.

GIVE ONLINEBeginning in 2026, new federal rules under the One Big Beautiful Bill Act will change how charitable deductions work:

• New 0.5% AGI floor for itemizers: Only the portion of charitable gifts above 0.5% of your Adjusted Gross Income (AGI) will be deductible.

• Reduced tax benefit for donors in the highest bracket: Individuals in the top federal income tax bracket will see the value of their charitable deduction capped at 35¢ of tax benefit per dollar donated.

• New deduction for non-itemizers: Those who take the standard deduction will be able to deduct up to $1,000 (single) or $2,000 (married filing jointly) in cash gifts to qualified public charities.

• Existing limits remain:

The 60% of AGI limit for cash gifts to public charities continues to apply.

Why This Matters for 2025

None of these new limits apply until January 1, 2026. That means gifts made in 2025 fall under the current, more flexible rules, including:

• No 0.5% AGI floor

• No 35¢ cap on the value of deductions for top-bracket donors

• Deductions available under today’s itemizing rules, subject to existing AGI limits

Making your gift before December 31, 2025 may allow you to maximize both your impact and your tax benefits.

The information above is provided for general educational purposes only and should not be considered legal or tax advice. Tax laws are complex and subject to change. Please consult your tax advisor to determine how these rules apply to your specific financial situation.

Please make your check payable to Friends of the Children - New York and send it to:

Friends of the Children – New York

1325 5th Avenue

New York, NY 10029

With more than two million Donor Advised Fund accounts in the U.S. holding over $250 billion, DAFs represent an incredible opportunity for collective impact. By giving through your DAF, you join a community of long-term partners who provide the steady support that allows every child to count on their Friend year after year.

A DAF is a simple, flexible way to manage your charitable giving—offering an immediate tax deduction, the ability to recommend grants to organizations like Friends of the Children - New York over time, and the opportunity to plan your giving strategically. To make a DAF gift, log in to your DAF sponsor’s portal (e.g., Fidelity, Schwab, BNY Mellon), recommend a grant to Friends of the Children - New York (EIN: 06-1597902), and consider setting up recurring or multi-year gifts to sustain our long-term promise to children.

Donating appreciated securities (such as publicly traded stock, bonds, or mutual funds) that you have owned for more than one year is a great way to support our work. Compared to donating cash or selling your appreciated securities and contributing after-tax proceeds, you may be able to automatically increase your gift and your tax donation.

When you donate securities to Friends of the Children - New York, you will receive a charitable income tax deduction for its full market value. Even better, you will avoid any capital gains tax on the increase in value of the stock since you purchased it.

Our corporate supporters share our commitment to social justice and equity and provide opportunities for Friends of the Children–New York in some of the following ways:

Contact Sandra Randon, Director of Development, at srandon@friendsnewyork.org for more information.

We are a very lean staff that focuses our donor dollars on program support, so we can always use support with services. If you want to give your professional skills please contact us at 332-249-5136 or srandon@friendsnewyork.org and let us know.

Friends of the Children - New York is a 501(c)(3) tax-exempt organization.

Federal Tax ID number of 06-1597902.